The link to the full story is

here

These days it seems as if a startup so much as glances in Marissa Mayer’s direction, it can expect a bid within 24 hours. There’s been a lot of buzz about Yahoo’s new role as an acquisition hound of late, and Mayer’s attempts to turn the beleaguered giant into a mobile-first company and energize its ranks with young, acqui-hired talent.

While reports had varied on the final purchase price, according to the filing, the acquisition of Waze was “for a total cash consideration of $966 million,” with “$847 million attributed to goodwill and $188 million attributed to intangible assets,” minus the $69 million in other net liabilities assumed from Waze’s books. Though the final number is subject to change, it’s now abundantly clear just how hungry Google was to beef up its social mapping data and prevent it from falling into the hands of its competitors.

On top of its new social mapping prize, Google has made another 15 acquisitions so far this year, shelling out $344 million in additional assets to buy companies like Wavii, Makani Power, Channel Intelligence and DNNresearch. Channel Intelligence represented the largest deal of the batch, with Google

paying $125 million to continue its charge on the eCommerce front as well.

With Wavii going for an estimated $30 million and 13 companies still accounted for, we can deduce that Google, like Yahoo, has also been making its fair share of small-ticket acqui-hires over the year. In fact, Google acquired 53 companies in 2012, chief of which was Motorola Mobility at a price tag of $12.5 billion. The rest of its acquisitions cost $1.1 billion.

Notably, Google was in the midst of carrying out this M&A strategy when Marissa Mayer left the company to become CEO of Yahoo, and it’s clearly one that she’s now using to shore up Yahoo’s weaknesses. Yahoo spent most of 2012 wrapped up in internal struggles and attempted board takeovers. Compared to Google’s 53 acquisitions in 2012, Yahoo only made two — both of which took place only after Mayer had taken over.

Since Mayer took the reins last summer, Yahoo has accelerated its acquisition strategy exponentially, making a whopping 18 acquisitions. And, while that’s mind-boggling enough as it is, Yahoo is likely far from calling it quits.

As my colleague Alex Wilhelm recently pointed out, Mayer actually has plenty of runway. Thanks to its stake in Alibaba, Yahoo has an ace up its sleeve that’s potentially worth tens of billion of dollars and which can continue to fuel its aggressive M&A strategy.

For many reasons, this is critical if Mayer is to have any shot at turning the ship around. If Yahoo really wants to strengthen its position in mobile and revamp

its aging video and media technology, the company has to continue going after outside talent.

SIMILAR APPROACH TO M&A, DIFFERENT STORIES

While Yahoo and Google are both making headlines for the slew of acquisitions they’ve made over the past year — and the money they’re spending to do it — this shared approach says very different things about what each company perceives as its greatest need (read: deficiency). Yahoo’s biggest problem, at least in the short term, is PR.

In other words, when Mayer took the helm, Yahoo has been spinning in circles for years. They were directionless and basically seen as a has-been company that had lost its relevance in the modern tech industry. By acqui-hiring young talent, Mayer is showing that she’s eager to return Yahoo to its former standing and regain its luster — in part, by make it attractive to younger entrepreneurs but also by updating its product to make Yahoo a destination for younger people in general.

Its billion-dollar acquisition of Tumblr is a prime example: Tumblr’s core user base consists of young people, teenagers and middleschoolers. So not only was Tumblr an opportunity to make Yahoo seem like a cool company for young people and generate more traffic, but it also allows Yahoo to play to its strength, leveraging its ad network to monetize Tumblr’s massive content silo.

Mayer’s approach to M&A is also proving that the company is eager to fix its lagging mail, search and news tools, which have been gathering dust and have been eclipsed by the likes of Google and Microsoft.

Some of these problems will be easy for Yahoo to address and fix in the short term, but they could also create more issues for the company over the long-term. Yahoo is attempting to make a litany of significant, structural changes all at once, making it tough to achieve any kind of real cohesion across its products. It may do wonders for the stock, but it could easily end up being an ad hoc, duct-tape-style solution that leaves the real, infrastructural dangers roiling beneath the surface.

In contrast, it’s taken years for Google to achieve any sort of cohesion across its own disparate products and projects. But its recently embarked on a new, “One Google Era,” in which the company has begun to prioritize collaboration and unification across its properties, which, in turn, gives more meaning to both its M&A and product strategies.

Google’s acquisition of Waze, for example, allows it to add a social layer to its existing mapping and navigation products, strengthening an already formidable arsenal of mobile properties, rather than, in Yahoo’s case, allowing it to start from square one.

Google is now focused on becoming a big data empire and adding pieces that will help it power its massive cloud services infrastructure and products that are decidedly focused on real time. This applies across its diverse properties, whether that’s to allow people to collaborate and communicate in real time through Hangouts, Docs or Gmail, search in real time or navigate in real time through Google Maps and Waze.

Going forward, Google will begin looking more to acquire and build products that will prepare it for increasingly direct competition with companies like Amazon. One place that Google has been struggling of late is in its e-commerce and shopping, where its ambitions haven’t been met with the usual rewards or dominance it’s come to expect from its ventures into search, mobile and advertising.

For example, while Google’s dominance in search remains, when it comes to discovery and engagement around products, Amazon has been leaving it in the dust. If Larry Page’s mission is for Google to use its real-time infrastructure to create utilities that are critical to their everyday lives — whether in communication or otherwise — falling behind in product marketplaces is a big problem.

That’s likely why Google is working to boost its marketplace ambitions with products like the rumored “Helpouts,” which could help find a real home for its mobile payment products, like Wallet, and communication product like Hangouts to power real-time commerce. Amazon and eBay have been busy tearing down the walls that stand in the way of buying and selling on the web. Now Google wants to join the fun, and tools like Helpouts point towards a future in which Google may begin acquiring the kind of talent that can help it to build a real marketplace on top of search and other core products

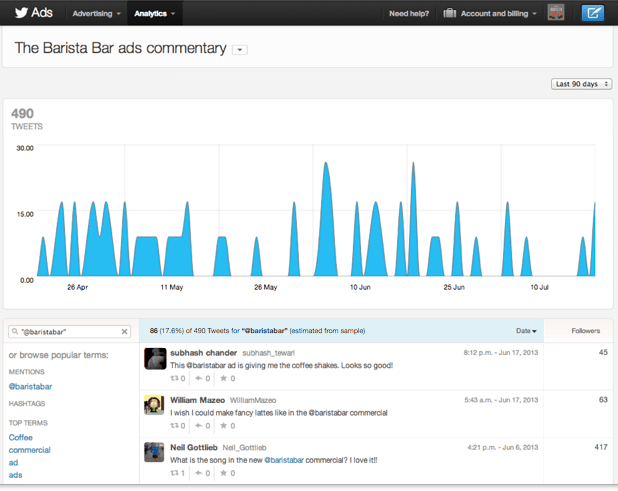

Of course Facebook has five times as many users as Twitter, so it’s not necessarily doing TV chatter better, it’s just bigger. Also, if Facebook does have more chatter, it’s not taking as strong of advantage of it as Twitter is here. Facebook has been publicly focusing its advertising efforts around retargeting and matching offline purchase data to users. Meanwhile, Twitter seems to be making big advances in semantic recognition of what people are talking about and how that can target ads. This could let it appeal to brands with big TV ad budgets that might be apprehensive about Facebook’s new-fangled ad services.

Of course Facebook has five times as many users as Twitter, so it’s not necessarily doing TV chatter better, it’s just bigger. Also, if Facebook does have more chatter, it’s not taking as strong of advantage of it as Twitter is here. Facebook has been publicly focusing its advertising efforts around retargeting and matching offline purchase data to users. Meanwhile, Twitter seems to be making big advances in semantic recognition of what people are talking about and how that can target ads. This could let it appeal to brands with big TV ad budgets that might be apprehensive about Facebook’s new-fangled ad services.