$FB is still stuck at $26.25, way down from its $38 IPO price, but it’s made important progress since going public a year ago. Daily users up 26%, mobile monthly users up 56%, and revenue up 38% are some highlights. It’s running out of people to sign up in the developed world, but with this growth and no serious competitor in sight, it’s survived its hardest year yet.

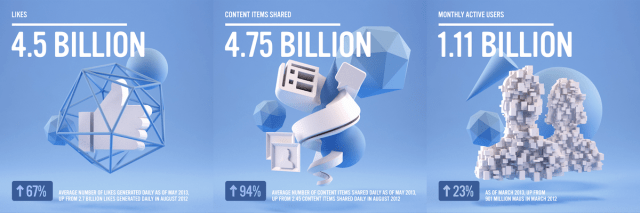

- Likes – 4.5 Billion – Up 67% – Average number of likes generated as of May 2013, up from 2.7 billion likes generated daily in August 2012

- Content Items Shared – 4.75 Billion – Up 94% – Average number of content items shared daily as of May 2013, up from 2.45 content items shared daily in August 2012

[Stats and images provided by Facebook]

Likes and sharing are growing faster than Facebook’s user count, indicating strong engagement. This contradicts rumors that people are tuning out of Facebook. Zuckerberg’s Law, the CEO’s Moore’s Law-style theory, states that people will share twice as much every year. Facebook almost made good on Mark’s claim. It’s important that Facebook keeps that number growing as it’s shared content that keeps people visiting Facebook and seeing its ads.

To do that, Facebook is working on the more immersive mobile experience Home which has increased time spent on Facebook by 25% for its small number of active users. More time spent could lead to more sharing. This year it doubled the speed of its massively popular iOS and Android by switching them from HTML5 to native architecture, which lead to longer session times. It added content-specific news feed to boost browsing, and launched Graph Search to pull additional value out its data and get people to contribute more.

It’s also been beefing up its mobile SDKs for iOS and Android to make it easier for apps to share content to Facebook. That’s a big reason Facebook cares about helping its developers grow — they’re scratching each other’s backs.

- Monthly Active Users – 1.11 Billion – up 23% – As of March 2013, up from 901 million MAUs in March 2012

- Daily Active Users – 665 Million – up 26% – On average as of March 2013, up from 526 million DAUs on average in March 2012

- Mobile Monthly Active Users – 751 Million – up 54% – As of March 2013, up from 488 million mobile MAUs in March 2012

- Instagram – 100 Million Monthly Active Users – As of February 2013

Facebook is still signing up people pretty quickly, but all users are not created equal. While it earned $3.50 per user in the U.S. and Canada in Q1 2013, it only made $0.50 per user in much of the developing world including India and Brazil. Those emerging markets are where Facebook is getting most of its growth, meaning each subsequent 100 million users added is worth less than the last.

Growth in mobile has a similar issue. Facebook can show as many as seven ads per page on desktop whereas it has to be more careful not to overwhelm the small screen on mobile. So as Facebook’s users shift their access medium to mobile, it may earn less on each of them. Facebook is hoping that getting developers to pay for mobile news feed ads to get their apps discovered could counteract this, and that market is poised to grow as more businesses launch apps and the developing world switches to smartphones.

Overall, though, Facebook is still growing strong nine years after launch. The network effect of its ubiquity should not be underestimated. Dislodging Facebook as the premier general purpose social network will require something that’s not just better, but much, much better. Competitors might pick away at certain use cases, but are unlikely to replace it as the core identity provider for the web. Considering Facebook’s willingness to buy out threats like Instagram (which is still growing quickly in the first world), could stave off disruption and let it reign for years to come.

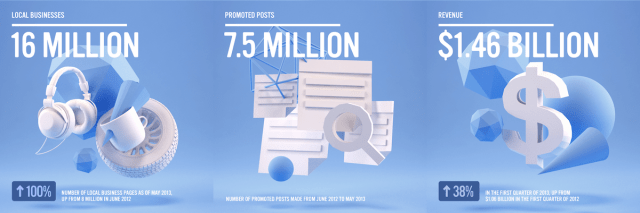

- Local Businesses – 16 Million – up 100% – Number of local business pages as of May 2013, up from 8 million in June 2012

- Promoted Posts – 7.5 Million – Number of promoted posts made from June 2012 to May 2013

- Revenue – $1.46 Billion – up 38% – In the first quarter of 2013, up from $1.06 billion in the first quarter of 2012

- Ad Revenue – $1.25 Billion – up 43% – In the first quarter of 2013, up from $872 million in the first quarter of 2012

- Employees – 4,900 – up 38% – As of March 2013, up from 3,539 in March 2012

- Game Payers – 24% more – Increase from March 2012 to March 2013

There’s no doubt about it. Going public made Facebook focus more on making money. It went from nearly zero revenue on mobile to $375 million a quarter, or about 30% of its total ad revenue. That in large part came thanks to the mobile app install ads it launched late last year. These let developers promote their apps in the Facebook news feed with ads that link straight to download pages in the Apple App Store and Google Play. These stores are getting more and more clogged with apps, inspiring developers to pay Facebook to get found.

Facebook also made big headway with Facebook Exchange, its retargeted ads that use people’s browser histories to show them highly relevant ads. FBX is absorbing advertiser budgets set aside for retargeting. Less successful has been Facebook Gifts, its entrance into direct e-commerce. Gifts has failed to produce meaningful revenue and may need to be overhauled to get more users purchasing real-life presents for their friends. Growth in payments revenue has been relatively slow too, as more game developers move from Facebook’s web canvas where it earns 30% to mobile, where Apple and Google get that cut.

One opportunity that should excite investors is that Facebook started showing ads in Graph Search. While they use the standard Facebook targeting now, they’re expected to incorporate keyword targeting, which could make them a more direct competitor to Google’s wildly lucrative AdWords business. The increasing technological savvy of local businesses could be a boon to Facebook in the future. Right now few of them actively buy social ads, but expect revenue to shift towards Facebook and away from less targeted print and telephone book ads in the future.

Still, Facebook isn’t trying to make as much money as it could. Another year went by without TV commercial-style auto-play video ads (though they’re rumored to be getting closer to this), and it even paused its experiment with a mobile ad network. If Facebook built out these streams it might piss some people off or make them feel like they data is being exploited, but it could definitely produce a huge boost in revenue. Off-site and off-app ad networks could let Facebook leverage its enormous wealth of personal data to power ads elsewhere so it can earn money without showing more ads on its own properties. That potential more than any is an argument for why Facebook is undervalued.

Most importantly of all, Facebook’s efforts to earn more money have not significantly impeded its mission of connecting the world. There are definitely more ads on Facebook, especially on mobile, but the data shows that they’re not annoying users enough to reduce their engagement.

Facebook has grown up. It’s no longer the red-hot startup that could double its user count every year. And it’s not the mature corporation churning out amazing profits by squeezing every last dime out of its data and usage. But Facebook has weathered the storm of going public without letting it destroy its regard for the user experience. It’s now a fundamental utility for most of the world. If it can keep from getting too greedy and stay focused on the long-term health of its community, it will have plenty of time to figure out how to turn the world’s life story into serious business.

No comments:

Post a Comment